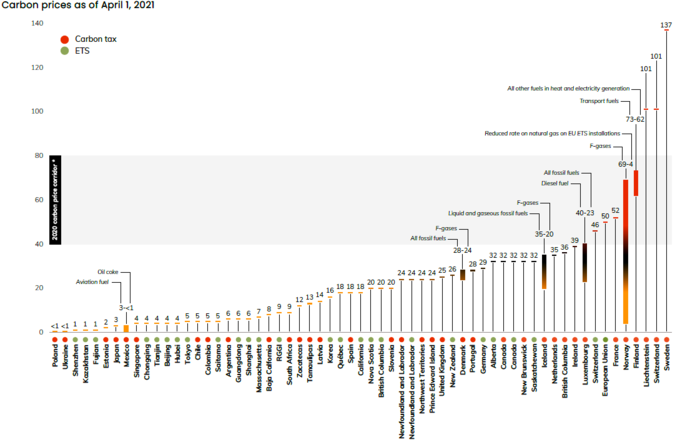

Underpinned by the 2015 Paris Climate Agreement, there have been growing concerns surrounding the structural changes necessary to support the global transition to a net-zero economy. Global efforts to address climate change are especially apparent with the increasing implementation of carbon dioxide (CO2) emission regulations - illustrated via taxes, emissions trading schemes (EMTs) and fossil fuel extraction fees. Having been implemented in over 40 countries and 20 cities and regions, carbon prices are imminently becoming an effective tool to aid the transformation of our global economy.

Carbon dioxide (or CO2) is a colourless, odourless gas consisting of one part carbon and two parts oxygen. CO2 is a natural component of our planet's atmosphere and is one of the most common greenhouse gases. It is released through human activities such as burning fossil fuels and deforestation, but also by natural processes.

Because humanity releases more carbon dioxide - primarily through burning fossil fuels like coal and oil - into the atmosphere than current biological processes can remove, the amount and concentration of carbon dioxide in the atmosphere and ocean increases yearly. There are other greenhouse gases beyond carbon dioxide, such as methane (CH4), nitrous oxide (N2O), or fluorinated gases (F-gases).

Carbon emissions (or greenhouse gas emissions) release carbon into the atmosphere. Carbon dioxide is the primary greenhouse gas emitted through human activities.

What is carbon pricing?

Carbon pricing is a popular mechanism that uses market drivers to address climate change action, by creating financial incentives for lowering carbon emissions or other gases such as methane and nitrous oxide that contribute to rising global temperatures. In a nutshell, carbon prices cover a part of a country’s total emissions, charging C02 emitters for each ton released’.

Not to be confused with carbon offsetting; carbon pricing plays a vital role through utilising market mechanisms to establish financial incentives that encourage the reduction of emissions. Accordingly, carbon pricing primarily takes place in the form of a fee, tax, or a cap-and-trade system; depending on government allotments or permits. Through establishing financial limitations and incentives, companies face immense pressure to restructure their processes to guarantee a reduction in carbon emissions, either via transitioning to sustainable fuels or more efficient processes.

In summary, carbon pricing utilises market mechanisms to establish financial incentives that encourage the reduction of emissions.

Carbon prices take place in various forms, these are the main types:

Carbon Tax or Carbon Fee: A system where the government sets a price that carbon emitters must pay in line with each unit of greenhouse gas (GHG) emissions they emit.

Emission Trading System (ETS): A permit system for GHG emissions which essentially sets a limit on emitted carbon emissions per company annually. Accordingly, the company in question is given a set allowance or they have to purchase the right to emit carbon. In doing so, companies that do not exceed their limit may choose to sell their ‘unused’ carbon emissions. Such a system is currently used across the European Union and thus sets a limit on GHG emissions, particularly in energy-intensive industries (e.g. oil, gas, steel, aviation).

Emission Reduction Funds: A system, which is currently utilised within Australia, which incorporates taxpayer funded schemes whereby a government buys credits created by emission reduction projects.

Cap-and-trade System: A system whereby the government defines an emissions cap, and from this a quantity of emission allowances are issued in line with that cap.

Internal Company Carbon Tax: A system where companies set a price for the pollution levels of their products, departments and/or regions in order to align all employees with broad net-zero targets.

Source: Climate Bonds

How is the price of carbon calculated?

So, how is carbon calculated and what does this mean?

Through capturing the external costs of carbon emissions, specifically the costs faced by the general public from climate related events, this cost can be placed back at its source. For instance, calculating the costs associated with events such as losses of property due to rising sea levels, losses of crops due to varied weather events, or the health costs associated with climate disasters, the costs of emitting carbon can be quantified.

There are various different models and studies to advise policy makers in relation to calculating carbon prices, as they are heavily dictated by the nature of the industry, the level of pollution, along with the wider net-zero goals of the particular country in question.

Accordingly, the following guide has been provided by the World Bank to illustrate the fundamental principles which underpin effective and successful carbon pricing:

- Fairness - Leading with a ‘polluter pays’ mentality and ensuring that both costs and benefits are equitably shared.

- Policy alignment - Ensuring that carbon pricing is implemented in conjunction with broader climate and non-climate policy goals.

- Stability - Ensuring that a clear, consistent and predictable policy framework is in place is key to facilitating a stable system with consistent messaging.

- Transparency - Ensuring transparency surrounding the carbon calculation methodology and goals that underpin an industry or country’s net-zero journey.

- Cost-efficiency - Making sure that the framework meets the necessary return-on-income and is cost effective.

- Reliability - Guaranteeing that the price calculation methodology does not undergo extreme fluctuation.

- Integrity - Ensuring that the carbon price fits within the broader sustainability and net-zero agenda is an extremely important consideration.

Source: World Bank

Understandably, there are some key challenges that arise when calculating and implementing carbon pricing policies. These challenges include the presence of poorly designed policies, confusing policy overlaps, the ineffective utilisation of revenues obtained from carbon prices, and the risk of carbon leakage.

Carbon leakage is an issue that arises primarily within global companies when they transfer production to countries with less emission constraints, thus meaning emissions were ‘exported’, and whilst the company appears more sustainable, the damage to the planet remains. This challenge can be addressed via the implementation of a strong carbon-pricing framework.

Source: Nomura

The influence of carbon pricing upon global decarbonisation

Carbon pricing ultimately plays a crucial role within the global journey towards decarbonisation due to the vast influence that carbon pricing frameworks exert upon emission reduction.The importance of carbon pricing is reflected through:

- Higher carbon prices hold the potential to improve profit margins for clean energy generation in Europe, including wind, solar, and nuclear power plants.

- Carbon prices encourage investment in new technologies, such as carbon capture. Meanwhile, average carbon prices are set to potentially increase more than sevenfold to US $120 per metric ton by 2030.

- Based upon S&P Dow Jones Indices, carbon pricing could lead to significant costs for companies, amounting to as much as US $1.3 trillion.

In summary, markets and governments setting carbon prices, and charging CO2 emitters via a tax or fee, is fundamental to ensuring the burden of CO2 emissions are placed on those who are most responsible. Whilst corporate social and environmental responsibility remains a key concern for businesses, the assessment of a business’ environmental footprint is increasingly becoming a crucial performance factor.

Therefore, it is imperative for companies and their stakeholders to account for carbon pricing risk within their operations in order to reduce their corporate carbon footprint.

See how monitoring and reducing carbon emissions can benefit your business. Book a free demo with Plan A.

.jpg)

.jpg)